Fair Value Gaps (FVG)

What is a Fair Value Gap (FVG)?

A Fair Value Gap (FVG) is a significant price action concept that represents a market inefficiency or imbalance in price movement. It appears when price makes a sudden, sharp move, leaving behind an area where no trading has occurred - essentially creating a "gap" in fair value.

Unlike traditional gaps that form between trading sessions, FVGs can form at any time during active trading when price moves rapidly enough to skip over certain price levels. These areas represent imbalances where buyers or sellers have overwhelmed the opposing side, creating a vacuum in price that often gets "filled" later as the market seeks equilibrium.

FVGs are considered important by many institutional and professional traders as they represent areas where the market has yet to establish "fair value" through the natural price discovery process.

Types of Fair Value Gaps

Bullish Fair Value Gap

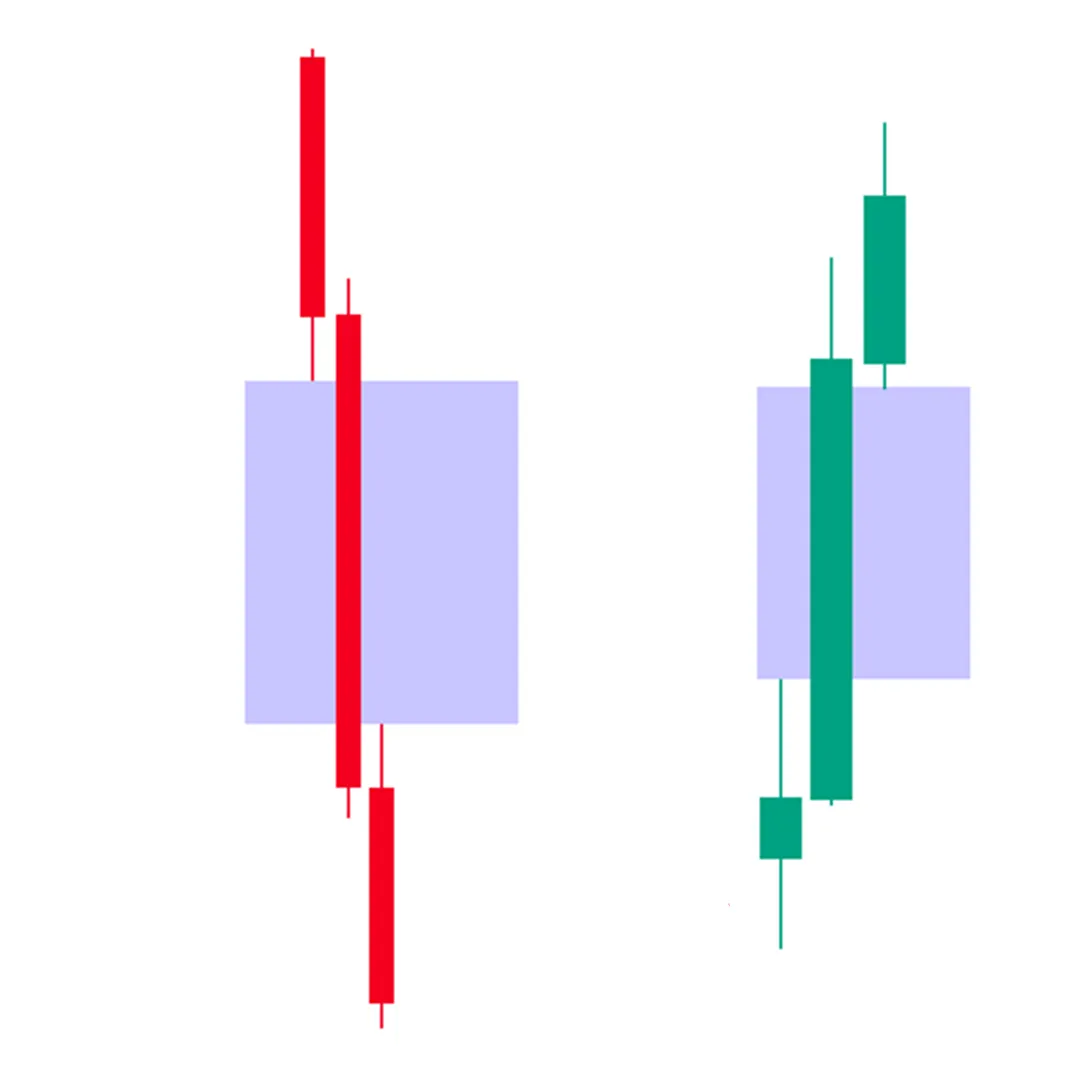

A Bullish FVG forms during an upward movement when price makes a sharp move up, creating a gap between the high of one candle and the low of another. Specifically, it appears when:

- The low of a candle is higher than the high of the previous candle

- There is a noticeable "gap" in the price chart where no trading has occurred

- It represents an area where buyers aggressively took control, outpacing sellers

Bullish FVGs often act as support zones when price retraces, as the market frequently returns to test these inefficiencies.

Bearish Fair Value Gap

A Bearish FVG forms during a downward movement when price makes a sharp move down, creating a gap between the low of one candle and the high of another. It occurs when:

- The high of a candle is lower than the low of the previous candle

- A noticeable gap appears in the price chart

- It represents an area where sellers aggressively took control

Bearish FVGs typically act as resistance zones when price rallies back up, as the market often returns to test these inefficiencies.

Why Fair Value Gaps Matter in Trading

FVGs have become increasingly important in modern trading for several key reasons:

- High Probability Zones - FVGs represent areas that the market often returns to "fill," creating potential trading opportunities

- Institutional Focus - Many professional and algorithmic traders monitor these inefficiencies

- Support/Resistance - FVGs frequently act as strong support or resistance levels until filled

- Market Psychology - They represent imbalances in buying and selling pressure that often correct

- Order Flow Insight - FVGs provide clues about aggressive institutional buying or selling

How to Identify Fair Value Gaps

Identifying FVGs on your charts requires attention to specific candle formations:

For Bullish FVGs:

- Look for three consecutive candles

- The middle candle should close higher than it opened (bullish)

- The low of the third candle should be higher than the high of the first candle

- The gap between the high of the first candle and the low of the third candle is the Bullish FVG

For Bearish FVGs:

- Look for three consecutive candles

- The middle candle should close lower than it opened (bearish)

- The high of the third candle should be lower than the low of the first candle

- The gap between the low of the first candle and the high of the third candle is the Bearish FVG

Trading Strategies Using Fair Value Gaps

There are several effective ways to incorporate FVGs into your trading approach:

1. FVG Fill Strategy

This is the most common approach to trading FVGs:

- Identify a clear FVG on your chart

- Wait for price to retrace toward the FVG

- Enter a position as price approaches or enters the FVG zone

- Place your stop loss beyond the FVG

- Target the complete filling of the FVG or extend your target based on market structure

2. FVG as Support/Resistance

Use FVGs as dynamic support and resistance levels:

- Bullish FVGs act as support when price pulls back

- Bearish FVGs act as resistance when price rallies

- Look for rejections from these levels with confirming price action (like rejection candles)

- Enter positions after confirmation of the rejection

3. FVG with Market Structure

Combine FVGs with broader market structure analysis:

- Identify the current market structure (uptrend, downtrend, range)

- Look for FVGs that form in the direction of the trend

- Use FVGs that align with key swing points or order blocks

- Enter positions when price returns to these structural FVGs

Important Considerations When Trading FVGs

While FVGs can be powerful trading tools, keep these important factors in mind:

- Not All FVGs Fill - While many FVGs eventually get filled, some may never be filled, especially in strongly trending markets

- Timeframe Matters - FVGs on higher timeframes (4H, Daily) tend to be more significant than those on lower timeframes

- Market Conditions - FVGs tend to work better in range-bound or moderately trending markets than in extremely volatile conditions

- Confluence Is Key - FVGs are most powerful when they align with other technical factors (support/resistance levels, Fibonacci retracements, etc.)

- Age of the FVG - Fresher FVGs (recently formed) tend to have a higher probability of being filled than older ones

Conclusion

Fair Value Gaps represent one of the most insightful concepts in modern price action trading. By identifying these market inefficiencies, traders can gain valuable perspective on institutional activity and potential future price movements.

While no trading concept works 100% of the time, FVGs provide reliable zones of interest that often lead to high-probability trading opportunities. By combining FVG analysis with solid risk management and an understanding of broader market conditions, traders can enhance their strategic approach to the markets.

Remember that trading FVGs, like any strategy, requires practice and screen time to develop proficiency. Start by simply identifying these gaps on your charts across different timeframes, and observe how price interacts with them before implementing them in your live trading.