Inverse Fair Value Gap (IFVG): Understanding Market Sentiment Shifts

What is an Inverse Fair Value Gap (IFVG)?

An Inverse Fair Value Gap (IFVG) is a concept in price action trading that occurs when a previously established Fair Value Gap (FVG) is invalidated by price breaking through it. This invalidation indicates a significant shift in market sentiment, transforming the original FVG into a potential support or resistance zone in the opposite direction.

While a regular Fair Value Gap represents an imbalance caused by strong directional movement, an IFVG emerges when that imbalance is overcome, signaling that the buyers or sellers who created the original gap have been overwhelmed by opposing market forces.

How Inverse Fair Value Gaps Form

Unlike regular FVGs which form as initial price imbalances, IFVGs are created through a transformation process:

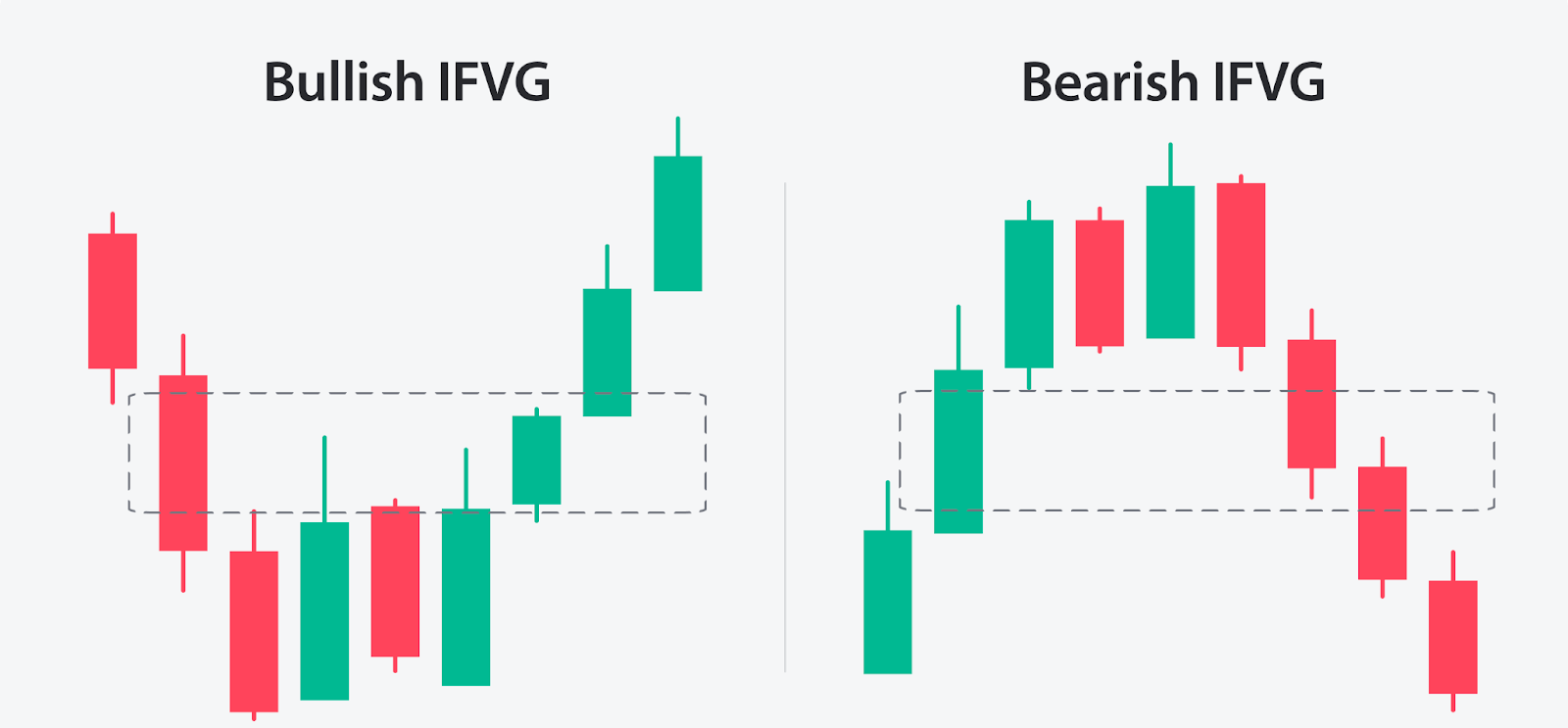

Bullish Inverse Fair Value Gap

A Bullish IFVG forms when:

- A bearish Fair Value Gap initially forms during a downward price movement

- Later, price breaks through this bearish FVG (either with a wick or candle close)

- This invalidation signals that sellers in that zone have been overwhelmed

- The original bearish FVG transforms into a bullish IFVG

- This zone now becomes a potential support level for future price action

When price later returns to this bullish IFVG zone, it may act as support, offering traders potential buying opportunities. If price breaks below the bottom of the IFVG zone, the pattern is invalidated.

Bearish Inverse Fair Value Gap

A Bearish IFVG forms when:

- A bullish Fair Value Gap initially forms during an upward price movement

- Later, price breaks through this bullish FVG (either with a wick or candle close)

- This invalidation signals that buyers in that zone have been overwhelmed

- The original bullish FVG transforms into a bearish IFVG

- This zone now becomes a potential resistance level for future price action

When price later returns to this bearish IFVG zone, it may act as resistance, offering traders potential selling opportunities. If price breaks above the top of the IFVG zone, the pattern is invalidated.

IFVG vs Regular Fair Value Gap: Key Differences

Understanding the difference between IFVGs and regular FVGs is crucial:

- Formation: Regular FVGs form directly from price movement, while IFVGs result from the invalidation of an existing FVG

- Market Signal: Regular FVGs indicate an initial imbalance, while IFVGs signal a shift in market sentiment

- Trading Approach: Regular FVGs often attract price for "filling," while IFVGs tend to reject price when retested

- Role Reversal: IFVGs represent a role reversal, where a former support becomes resistance or former resistance becomes support

Trading Strategies Using Inverse Fair Value Gaps

IFVGs can be powerful tools in your trading toolkit. Here are several ways to incorporate them into your strategy:

1. Sentiment Shift Trading

IFVGs highlight areas where market sentiment has changed significantly, making them valuable for:

- Identifying potential reversal zones where institutional players may have shifted direction

- Spotting early signs of trend changes before they become obvious on larger timeframes

- Finding high-probability entry points with defined risk levels

Strategy: When an IFVG forms, especially if it coincides with other structure changes like breaks of structure (BOS) or changes of character (CHoCH), prepare for entries when price retests the IFVG zone.

2. IFVG as Support/Resistance

IFVGs often function as key levels in the market, creating strong price reaction zones:

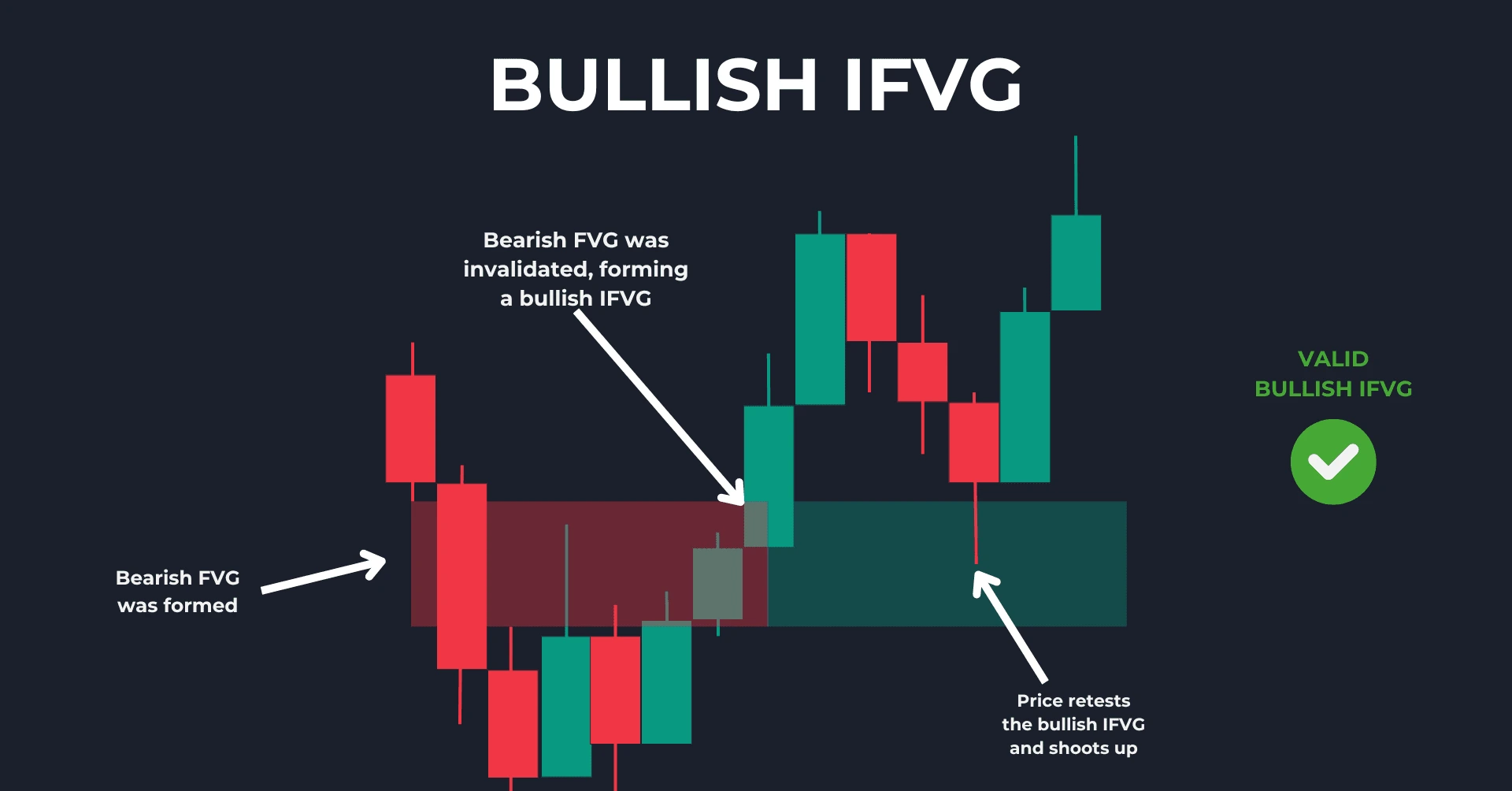

Bullish IFVGs as Support

Bullish IFVG providing support on a retest

When a bearish FVG is invalidated and becomes a bullish IFVG:

- Price often respects this zone as support when it retests the area

- The break of the original FVG signifies that sellers have lost control

- Smart traders look for long entries when price returns to this zone

- The bottom of the IFVG often serves as an optimal stop-loss level

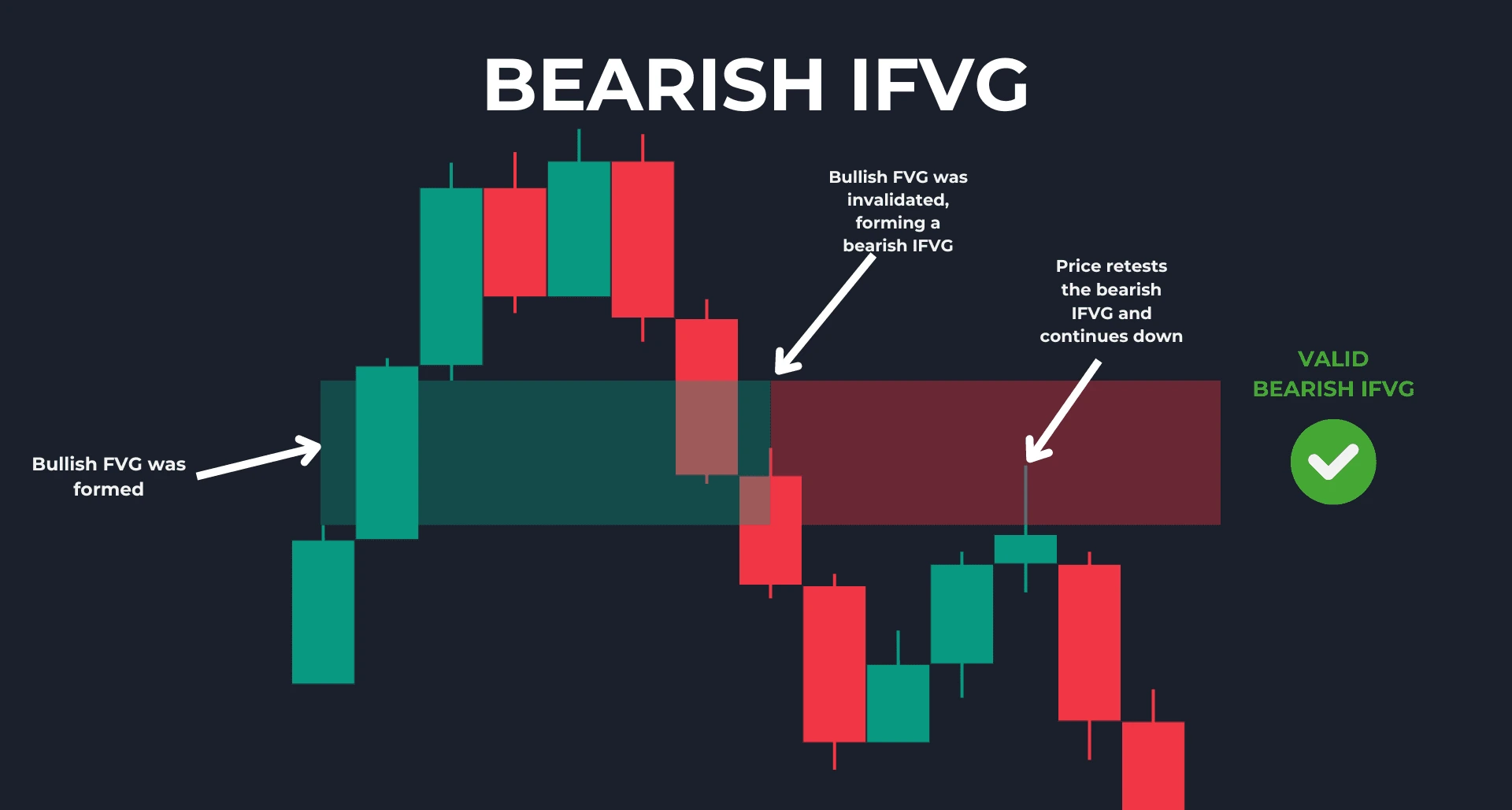

Bearish IFVGs as Resistance

Bearish IFVG providing resistance on a retest

When a bullish FVG is invalidated and becomes a bearish IFVG:

- Price tends to reject from this zone when it retests the area

- The break of the original FVG demonstrates that buyers have lost control

- Smart traders look for short entries when price returns to this zone

- The top of the IFVG often serves as an optimal stop-loss level

Trading Strategy: When price approaches an IFVG zone, look for confirmation signals like rejection candles, order blocks forming, or momentum shifts before entering trades in the direction of the likely rejection. The most powerful IFVG setups often occur when:

- The IFVG aligns with the higher timeframe trend direction

- Multiple technical factors converge at the IFVG zone (such as key moving averages or Fibonacci levels)

- Price shows a clear reaction (rejection) at the zone with strong momentum

3. High-Probability IFVG Areas

Not all IFVGs are created equal. The most reliable ones tend to form:

- After liquidity sweeps, where price takes out obvious stops before reversing

- In discount zones (the lower half of a bullish leg or upper half of a bearish leg)

- Following failed market structure shifts on lower timeframes

Strategy: Focus on IFVGs that form in these high-probability contexts, particularly when they align with the broader market bias from higher timeframes.

Best Practices for Trading IFVGs

To effectively utilize IFVGs in your trading:

- Establish Market Bias: First analyze higher timeframes to determine the overall trend direction before trading IFVGs

- Look for Confirmation: Wait for price to show respect of the IFVG level through rejection patterns or candlestick formations

- Set Proper Stop Loss: Place stops just beyond the IFVG zone or at a nearby swing high/low

- Define Targets: Use a calculated risk-reward ratio (like 1:3) or target significant structural levels

- Combine with Other Concepts: Use IFVGs alongside order blocks, breaker blocks, and liquidity analysis for stronger setups

Common Mistakes When Trading IFVGs

Avoid these pitfalls when incorporating IFVGs into your trading approach:

- Trading All IFVGs: Not every IFVG will result in a profitable trade - focus on those with the strongest context

- Ignoring Market Context: IFVGs work best when aligned with the higher timeframe trend or at key structural points

- Skipping Confirmation: Entering solely based on price reaching an IFVG without waiting for rejection signals

- Overlooking Invalidation: Failing to exit when price moves beyond the boundaries of the IFVG, invalidating the setup

Conclusion

Inverse Fair Value Gaps represent significant shifts in market sentiment, highlighting areas where the original imbalance has been overcome by opposing forces. These transformed zones often become important support or resistance levels that can provide traders with well-defined entry opportunities.

When used within the proper context and combined with other smart money concepts, IFVGs can help traders identify high-probability trade setups with clear risk parameters. Like all trading tools, they are most effective when integrated into a comprehensive strategy that considers market structure, timeframe alignment, and proper risk management.

By understanding how IFVGs form and what they signal about underlying market dynamics, traders can gain valuable insights into potential price reactions at these levels, allowing for more precise entries and better trade management.